Accepting International Payments: Expanding Your Business Globally

Accepting International Payments: Expanding Your Business Globally

Expanding your business internationally opens up a world of opportunities. With the global market at your fingertips, you have the potential to reach millions of new customers. However, to successfully expand globally, it’s essential to have a seamless and efficient international payment system in place. In this blog post, we’ll dive into the importance of accepting international payments and provide valuable insights on how to do it.

Why Accepting International Payments is Crucial

Expanding your business globally requires addressing the unique needs of international customers. One of the most critical aspects is offering convenient and secure payment options. Here’s why accepting international payments is crucial:

- Reach a broader audience: By accepting international payments, you can tap into new markets and potential customers worldwide, expanding your customer base.

- Increase sales and revenue: A seamless international payment process removes barriers for customers, leading to increased sales and ultimately boosting your revenue.

- Build trust and credibility: Offering local payment options instills trust and credibility in customers abroad, showing them that you are committed to their needs.

- Stay competitive: In today’s digital era, businesses that don’t accept international payments may be left behind. Stay ahead of the competition by catering to customers worldwide.

How to Accept International Payments

Accepting international payments may seem complex, but with the right tools and strategies, it can be relatively straightforward. Here are three essential steps to get started:

1. Research local payment preferences

Each country has unique payment preferences. Conduct thorough research to understand which payment methods are widely used in the target markets you wish to expand into. This will help you optimize your payment options to cater to local preferences, increasing customer satisfaction.

2. Use a reliable international payment gateway

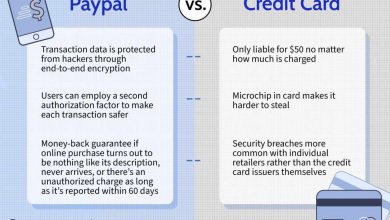

An international payment gateway acts as a bridge between your business and customers around the world. Look for a reliable provider that supports multiple currencies and payment methods while ensuring secure transactions. Examples of leading international payment gateways include PayPal, Stripe, and Worldpay.

3. Address currency and exchange rate challenges

Currency conversion and fluctuating exchange rates can pose challenges when accepting international payments. Consider the currency options you want to offer to customers and find a payment gateway or service that simplifies the currency conversion process, minimizes fees, and provides competitive exchange rates.

Frequently Asked Questions (FAQs)

Q1: Are there additional fees for accepting international payments?

A1: Yes, there may be additional fees associated with accepting international payments. These fees can vary depending on the payment gateway or service you use. It’s essential to review the fee structures and factor them into your pricing strategy.

Q2: Can I accept international payments with my current payment processor?

A2: It depends on your current payment processor. Some processors offer international payment capabilities, while others may have limitations. Check with your payment processor or consider exploring other options if necessary.

Q3: How long does it take to receive international payments?

A3: The time it takes to receive international payments can vary depending on several factors, including the payment method, currency conversion, and the country of origin. Familiarize yourself with the typical transaction processing times for different payment methods to set accurate expectations for your customers.

Q4: How can I ensure the security of international transactions?

A4: Security is paramount when accepting international payments. Implement secure payment gateways that offer strong encryption protocols and fraud detection measures. Additionally, securing your website with SSL certificates creates a safe environment for customers to make transactions.

Conclusion

Expanding your business globally requires a seamless international payment system. By accepting international payments, you can reach new audiences, increase sales, and build trust with customers abroad. Research local payment preferences, choose a reliable payment gateway, and address currency challenges to create a smooth payment experience. With the right strategy in place, your business can thrive in the global market.

Have more questions about accepting international payments? Feel free to reach out to us [Include contact information]