The Role of Mobile Money in Wealth Creation

**

The Role of Mobile Money in Wealth Creation**

**

Introduction**

In today’s digital age, mobile money has emerged as a game-changer in the financial services industry. Mobile money refers to the use of mobile phones to perform financial transactions conveniently and securely. With the rise of smartphones and mobile connectivity, this technology has transformed the way people manage their money and has significant potential for wealth creation.

**

How Mobile Money Boosts Financial Inclusion**

One of the primary reasons mobile money plays a vital role in wealth creation is its ability to enhance financial inclusion. Traditional banking services are often inaccessible in rural areas, making it difficult for people to save, send, or receive money securely. However, with mobile money, anyone with a basic mobile phone can access financial services, eliminating the need for physical bank branches. This increased access to financial services opens up new opportunities for individuals to grow their wealth.

**

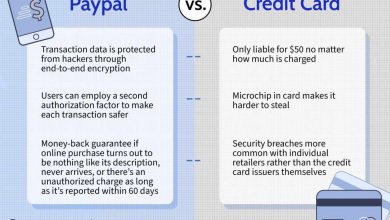

Facilitating Secure and Efficient Money Transfers**

Mobile money offers a convenient and secure way to transfer funds, both domestically and internationally. Users can transfer money to friends, family, or business associates instantly, reducing the need for physical cash or lengthy bank procedures. Additionally, the transaction fees associated with mobile money are often lower than traditional remittance services, making it a cost-effective approach to facilitating wealth creation.

**

Enabling Savings and Investment**

Mobile money platforms also allow users to save and invest their money easily. Mobile wallets act as digital savings accounts, where individuals can safely store their funds and earn interest over time. Furthermore, mobile money providers often collaborate with financial institutions to offer investment products such as bonds or mutual funds, enabling individuals to grow their wealth through diverse investment opportunities.

**

Expanding Access to Credit and Microfinance**

Access to credit is critical for wealth creation, especially for small business owners and entrepreneurs. Mobile money platforms have expanded access to credit and microfinance options for individuals who would otherwise be excluded from traditional banking services. By utilizing alternative data sources and advanced algorithms, mobile money providers can assess creditworthiness more accurately, allowing underserved populations to access loans and kick-start their entrepreneurial ventures.

**

FAQs about Mobile Money and Wealth Creation**

**

1. Is mobile money safe to use?**

Yes, mobile money is built on secure technologies such as encryption and mobile device authentication, making it a safe and reliable method for financial transactions. However, it’s essential to follow standard security practices like using strong passwords, avoiding sharing sensitive information, and keeping your mobile device updated.

**

2. Do I need a smartphone to use mobile money?**

No, you don’t necessarily need a smartphone to use mobile money. Basic mobile phones with SMS capabilities can also be used to access various mobile money services. However, smartphones offer a more robust user experience with additional features and functionalities.

**

3. Can mobile money help me save money?**

Absolutely! Mobile money platforms often provide built-in savings features, allowing users to set aside funds and earn interest. Additionally, the ease of sending and receiving money using mobile money can promote better financial management, leading to increased savings and wealth accumulation over time.

**

Conclusion**

Mobile money is revolutionizing the way people manage their finances and has a significant impact on wealth creation. By expanding financial inclusion, facilitating secure money transfers, enabling savings and investment opportunities, and extending access to credit, mobile money is leveling the playing field and empowering individuals to build and grow their wealth like never before. Embracing this technology can be a game-changer for anyone seeking to enhance their financial well-being.